These mystifying numbers not only impact your ability to borrow money but also affect various other aspects of your life, from renting an apartment to the interest rates on loans.

Want to know how you can master your credit score? Keep reading!

Understanding Credit Scores

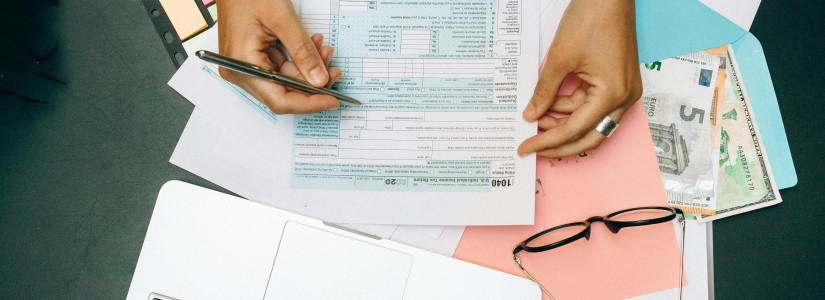

At the heart of your financial health is your credit score, a complex number derived from five key components:

- Payment history: How timely you are with your payments.

- Credit utilization: The ratio of your current debt to your total available credit.

- Length of credit but history: How long you've been using credit.

- Types of credit: The variety of credit products you have.

- New credit applications: How often you apply for new credit.

Each element plays a unique role in composing your overall score, reflecting your reliability as a borrower.

Building Credit from Scratch

Starting your credit journey can feel akin to a chicken-and-egg scenario; to build credit, you need credit. However, there are accessible strategies:

- Becoming an authorized user on a family member or a friend's account.

- Applying for a secured credit card, which is backed by a cash deposit you make upfront.

- Using credit-building loans, specifically designed to help establish credit history.

- Remember, the key lies in responsible use, primarily making on-time payments, as it profoundly influences your score.

Improving an Existing Credit Score

If your credit score isn't where you'd like it to be, don't fret. There are actionable steps to give it a boost:

- Reduce your credit card balances: Lowering your credit utilization ratio can positively impact your score.

- Dispute any errors on your credit reports: Mistakes can happen, and rectifying them can improve your score.

- Increase credit limits: If done responsibly, this can lower your credit utilization ratio.

- Diversify your credit mix: A healthy variety of credit accounts can demonstrate your credit management skills.

- Patience is key; depending on your actions, improvements can be noticed within a few months to a year.

Monitoring and Maintaining Credit

Like any aspect of personal finance, maintaining good credit requires regular attention:

- Regularly check your credit reports for inaccuracies.

- Utilize free credit monitoring services to stay informed of any changes.

- Develop healthy long-term credit habits, like always paying bills on time and keeping balances low.

Special Considerations

Life events such as job loss or divorce can impact your credit.

Moreover, rebuilding credit after bankruptcy or other setbacks is challenging but entirely possible with strategic financial behavior.

Find more financial tips and assistance in Personal Finance Hero.

Takeaway

Credit management is a lifelong journey that demands ongoing attention and action.

By understanding how credit scores work, and taking proactive steps to build or improve your credit, you're setting the stage for a financially healthy life.

Whether you're just starting or looking to boost your score, remember that every step taken is a move toward better financial wellness.

Encourage yourself to keep informed, remain patient, and practice disciplined credit habits. Your future self will thank you!