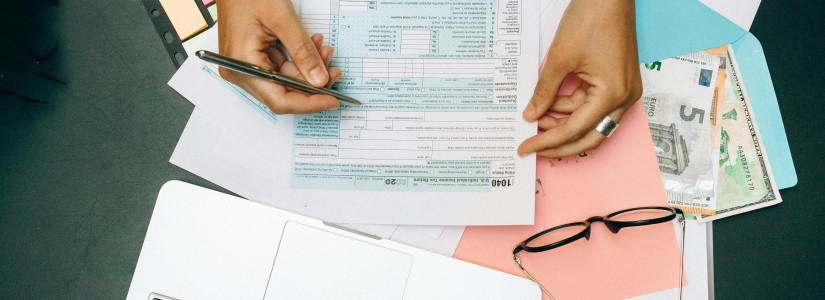

As the tax landscape continually evolves, keeping abreast of annual updates and changes is crucial for compliance and maximizing potential refunds.

Key Tax Changes for 2024

In 2024, there will be some adjustments to ease tax burdens and account for economic shifts such as inflation. This includes revised tax brackets and standard deductions.

The income ranges for each tax bracket have been broadened, potentially leading to lower tax rates for some earners.

Moreover, standard deduction amounts have risen, offering more non-taxable income for everyone.

New and Expanded Tax Credits

Several new initiatives and modifications to existing tax credits have been introduced:

- Electric Vehicle (EV) Tax Credit: Big news for eco-friendly drivers! Changes to the EV tax credit not only increase the credit amount up to $7,500 but also allow you to apply this benefit directly at the point of sale, offering immediate savings. However, be mindful of the income limits and other eligibility requirements.

- Child Tax Credit (Pending): A hopeful boost for families might come through an expanded child tax credit, potentially increasing to $3,600 — though this is contingent on congressional approval.

- Home Energy Efficiency Improvements: Planning to retrofit your home to be more eco-friendly? A beefed-up 30% credit for certain energy-efficient home improvements could make these upgrades more affordable.

Deductions to Consider

Don't overlook these valuable deductions that can further reduce your taxable income:

- Student Loan Interest: For those paying off student loans, the ability to deduct interest can lead to meaningful tax relief.

- Retirement Contributions: Contributions to retirement accounts like a 401(k) or IRA can lower your taxable income and enhance your future financial security.

- Charitable Donations: Giving back doesn't just feel good—it can also be beneficial come tax time, as charitable contributions remain deductible.

Filing Options and Assistance

Filing taxes has gotten a bit easier with new programs aimed at simplifying the process:

- IRS Direct File: This new initiative offers a free tax filing option, making it easier for taxpayers to comply without additional costs.

- Expanded IRS Free File: The income threshold for this free service has increased to $73,000, making it accessible to more taxpayers.

When it comes to navigating these options and utilizing them correctly, consulting with a tax professional can be incredibly beneficial, especially for those with complex tax situations or new changes to their financial circumstances.

Check out E-Z Tax Advisors for more tips and tax assistance.

Conclusion

Staying informed about changes in tax law is more crucial than ever.

With the variety of adjustments in 2024, early planning and preparation can help ensure that you take full advantage of available tax credits and deductions.

Start reviewing your tax strategy now to maximize your refund, improve your financial health, and avoid last-minute stress. Remember, effective tax planning requires attention and consideration throughout the entire year!