Let's explore a range of straightforward and effective strategies for comprehensively streamlining and enhancing your approach to managing your finances.

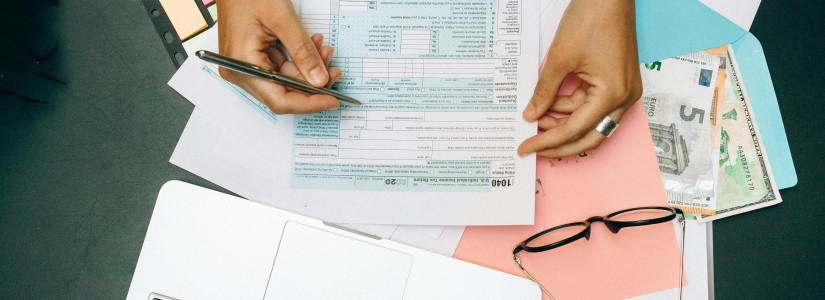

Define Your Income

The first step to any budget is knowing exactly what you’re working with. Calculate your total monthly income, leaving no stone unturned.

Include your regular paychecks, any side hustles, passive income, or additional financial sources. Having a clear picture of your income is the foundation of successful budgeting.

Categorize Your Expenses

Now, let’s peek at where your cash flows. Group your expenses into clear categories such as housing, transportation, food, healthcare, and discretionary spending.

Don’t just guess; go through your bank statements to be precise. This exercise will show you the truth about your spending habits and help you make informed adjustments.

Follow the 50/30/20 Rule

The 50/30/20 rule is your new budgeting buddy.

It’s simple: 50% of your net income goes to needs (like rent and groceries), 30% to wants (hello, Netflix!), and the remaining 20% towards savings or chipping away at debt.

It’s a flexible framework that can be tailored but provides a solid foundation for financial wellness.

Set Budgeting Goals

What’s money for if not to make dreams come true? It could be an emergency fund for rainy days, a vacation fund for sunny escapes, or saving for a shiny new car.

By setting clear short-term and long-term goals, you'll have something tangible to work towards.

Allocate a certain portion of your income every month to each goal and watch your dreams materialize.

Track Your Spending

Keep an eagle eye on your spending.

Compare your actual expenses to your budget to pinpoint where you can cut back or where you need to reallocate funds.

And hey, make life easier by automating your savings – out of sight, out of mind, but growing steadily.

Check out: Revolutionizing Personal Finance: The Best Money-Saving Apps of 2024

Adjust as Needed

Here's the thing: budgets aren’t set in stone. They’re living, breathing things that should shift as your life does.

Promotions, new hobbies, or unexpected expenses will all call for a little budget tweak. Regular reviews of your budget keep it realistic and effective.

Cutting back on spending doesn't have to be a drag; it's about making smart choices that align with your financial vision. With these actionable steps, you’re not just managing your money, you’re taking charge of your future.

So whether you’re saving for a lavish wedding, keen to knock out that student loan, or simply aiming for more wiggle room in your monthly finances, a solid budget is your blueprint to success.

For more tips and information on saving, check out Super Savers United.