Market volatility, geopolitical tensions, and inflation concerns are just the tip of the iceberg that today's investors need to navigate.

This has made seeking expert financial advice not just helpful, but essential. Here’s what financial advisors are saying about current events and how they're guiding clients through these choppy waters.

Market Volatility and Investment Strategies

Recent market fluctuations have left many investors feeling queasy. Advisors pinpoint a variety of causes, including political uncertainties, global health concerns, and shifts in technology.To combat this, financial gurus universally stress the importance of portfolio diversification. Long-term investment strategies tend to win the race, they advise, but there's also a place for well-considered short-term moves. It's all about balancing the scales and staying the course.

Impact of Global Events on Personal Finance

The world feels smaller every day, and events thousands of miles away can ripple through your investment portfolio. Geopolitical tensions and international market swings can unnerve even the steadiest of investors.Financial experts recommend diversifying not just across asset classes, but across geographies, and keeping an eye on safer havens to mitigate risks associated with international upheaval.

Inflation Concerns and Wealth Preservation

With current inflation rates stirring unease, preserving the value of your savings has never been more crucial. Advisors suggest leaning into investments that have traditionally served as hedges against inflation, such as real estate or certain commodities.Treasury Inflation-Protected Securities (TIPS) and certain stocks can also help protect your wealth from the eroding effects of rising prices.

Retirement Planning in the Current Climate

Adjusting your retirement strategy might be necessary amid economic uncertainties. Financial advisors emphasize finding the right balance between risk and security, considering the longevity of your portfolio.Whether you're eyeing early retirement or contemplating delaying it, each decision requires a thoughtful approach to ensure your golden years are indeed golden.

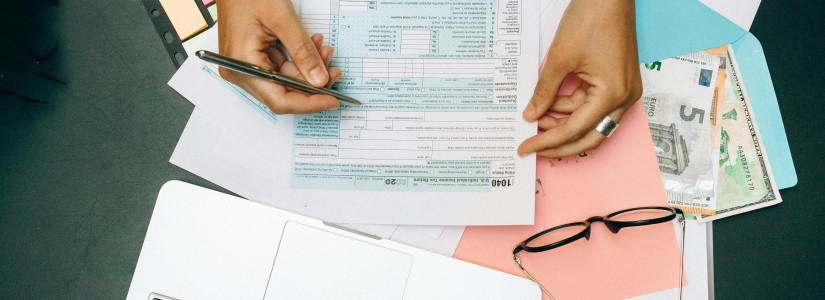

Tax Planning and Recent Legislative Changes

Recent tax law changes have a direct impact on personal finance strategies. Keeping abreast of these changes, and planning with an eye on tax efficiency, can significantly affect your financial health.Financial advisors are closely monitoring potential future shifts in tax policy, advising clients on smart moves today that will prepare them for tomorrow’s tax landscape.

Real Estate Market Insights

The real estate market has been a topic of much speculation, with trends in both residential and commercial sectors evoking varied opinions from experts.Advisors note the importance of real estate in a diversified portfolio but caution against seeing it as a panacea. With mortgage rates in flux, they suggest a measured approach to homebuying or investing in real estate.

Emerging Financial Technologies and Their Impact

Fintech is revolutionizing personal finance, offering tools for everything from budgeting to investing. Cryptocurrency and blockchain technology, though still in their nascent stages, are topics of interest for many financial advisors.They encourage a balanced approach, recognizing the value of new technologies while maintaining a foundation in traditional financial tools.

Sustainable and Ethical Investing Trends

The rise of ESG (Environmental, Social, Governance) investing reflects a growing desire among investors to align their portfolios with their values.Financial advisors see this not just as a trend but as a shifting paradigm, highlighting the solid performance of many ethical investments and their role in a modern, diverse portfolio.

Conclusion

Listening to financial advisors, it's clear that personalized advice has never been more valuable. Amidst economic uncertainties, their insights offer a path to clarity and confidence.Experts encourage readers to review and adjust their financial plans regularly and remind us of the enduring importance of strategic, informed investment decisions tailored to individual needs and goals. In these unpredictable times, that might just be the closest thing to a sure bet.

For more news, updates, and articles, subscribe to our Newsletter now!