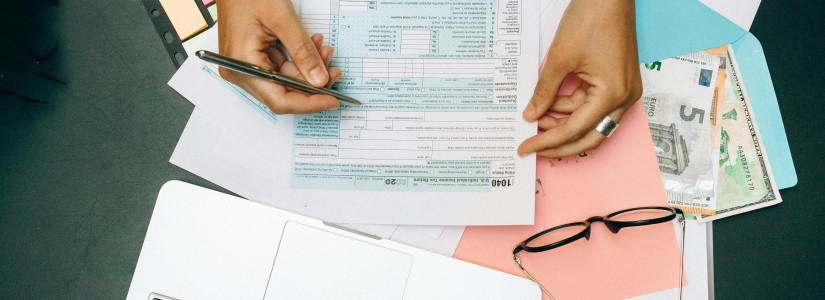

Fluctuating Tax Brackets and New Thresholds

Due to inflation, the income tax brackets have broadened, meaning more room before you jump to the next tax rate.At the same time, thresholds for capital gains and qualified dividends have been updated. It's essential to know where you stand to plan accordingly.

See the new tax brackets here.

Health Savings Flexibility: Increased HSA and FSA Limits

Healthcare savings have gotten a generous boost with record-high HSA contribution limits set for 2024.Individuals can now contribute up to $4,150, while families can allocate up to $8,300 towards their Health Savings Accounts.

Also, the Health Flexible Savings Account deferral limit sees an increase to $3,200, granting more leeway to those planning for healthcare expenses.

Explore HSA benefits and limits.

Medicare Gets More Inclusive

A ray of good news for Medicare Part D recipients: the Low Income Subsidy, affectionately known as "Extra Help," is now accessible to more beneficiaries, making essential medications more affordable for lower-income individuals.Learn about Medicare's "Extra Help" program.

Revamping Tax Credits, Deductions, and Legislative Watch

New rules for calculating the Child Tax Credit are in place for the 2024 and 2025 fiscal years—a change worth noting for families.Meanwhile, potential shifts to state and local tax deduction caps are on the legislative horizon, poised to affect many taxpayers.

Find the latest on tax credit changes.

Generous Gift and Estate Tax Adjustments

For those planning their estates or considering generous gifts, the exemption and exclusion amounts have climbed.The lifetime estate and gift tax exemption now stands at an impressive $13,610,000, with the annual gift tax exclusion reaching $18,000 per recipient — an increase that can significantly impact estate planning strategies.

Review the updated estate and giving guidelines.

Business Tax Overhaul: A Closer Look

Business owners, take note: the first-year bonus depreciation rules have been revised, potentially affecting your tax positioning and bottom line.Understand the new business tax rules.

Enhancing Employee Commuting Benefits

Employer-provided perks are seeing a positive change, too. The cap on tax-free parking benefits offered by employers has grown to $315 per month.Moreover, there's a matching exclusion for those using mass transit passes and commuter vans.

Check out the enhanced fringe benefits.

Keeping An Eye on Capitol Hill

The Tax Relief for American Families and Workers Act of 2024 is a significant legislative accomplishment, with ongoing debates signaling the possibility of further tax reforms.These discussions have the potential to shape the tax landscape substantially, so staying tuned to these developments is recommended.

-

All these changes underscore how our financial health and planning unavoidably hinge on policies and laws that are in a state of constant flux.

By staying informed, you can navigate these waters with confidence, ensuring that you make the most of the new rules and seize the opportunities that arise in 2024.

Keep this guide handy as you adjust your budgets, plan your healthcare spending, and align with the adjusted tax structures. Here's to a well-prepared and financially savvy year ahead!

For more access to articles and guides about taxes, check out E-Z Tax Advisors.